Decrypting the 'who' of Coinbase

What the talent of Coinbase tells us about its history, capabilities, and potential future direction.

There’s been quite the buzz around Coinbase given its direct listing last month. Much has been written on the what of Coinbase, but what can we find out about the who?

Using outside-in data, we reconstructed the history of Coinbase to learn about the company through a talent lens.

Sign up for our closed beta at get.aura.ceo if you’re interested in this analysis and would like to take our tool for a spin — door is open for beta testers 🔑!

Like many unicorn startups, we find Coinbase’s origins with Y-Combinator, where founder Brian Armstrong (Ex-Airbnb technical PM) was part of the S12 cohort in 2012 (notable contemporaries: Instacart, Lever, Zapier). You can find Brian’s demo-day deck here.

Talent scaling

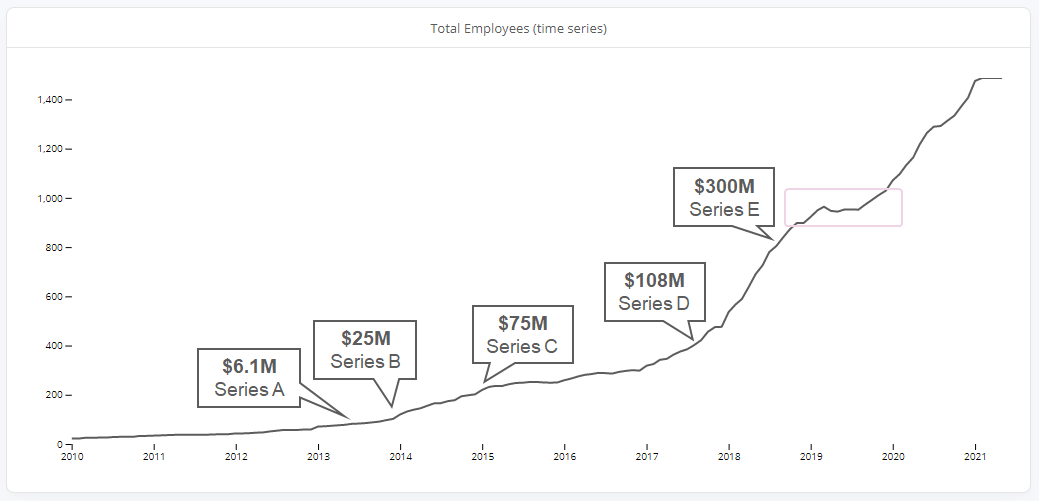

Looking at overall talent growth, we can see the upward trend coinciding unsurprisingly with major funding rounds — acceleration can be observed at Series B and D funding. However, employee growth trajectory was relatively unchanged with Series C, which seems like a bit of an anomaly (stashing or spending on other assets?).

We observe a plateau in H2 of 2019. This could be a hiring freeze or potentially higher than normal attrition as we’re looking at net employees. Closer inspection around that timeframe relative to previous trend shows suppressed new hires during this period. It’s important to note that Bitcoin was trading low for most of H1 2019 after the boom in 2018, which may have caused some caution in hiring additional headcount.

Looking at the BTC price, we can see that the new hires data follows a similar pattern, with a couple of months lag (BTC price increase begets bullish hiring and vice-versa).

Talent Composition

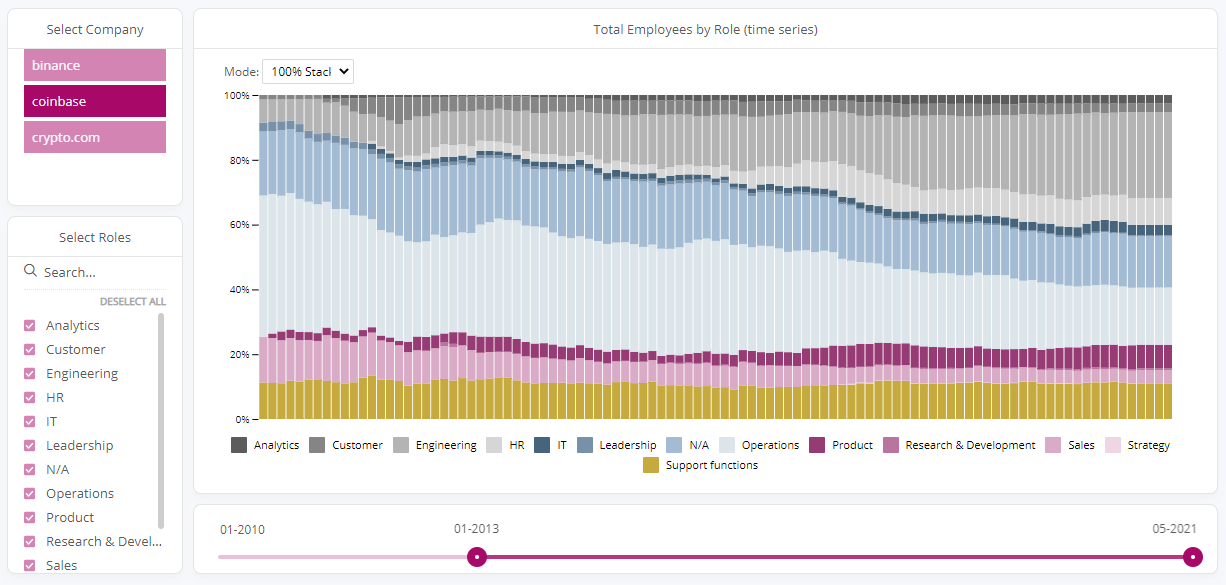

Seeing how a company’s talent composition changes through time can shed some light on strategic priorities. In the case of tech companies, we can also get a glimpse into scalability and how much “manual” work is still required. One way to get a read on this is comparing engineers to non-engineers. The clearest trend at Coinbase since inception is growth in engineering (medium gray) and reduction in operations (light blue). Our data show that roughly ~27% of Coinbase’s employee base are engineers today vs. ~10% in 2015.

Sources and destinations

So, we’ve got a sense of the overall talent growth story…but can we do a bit better to get a sense for quality of talent? One angle is to see who they’re attracting talent from and perhaps even more importantly, who they’re losing talent to.

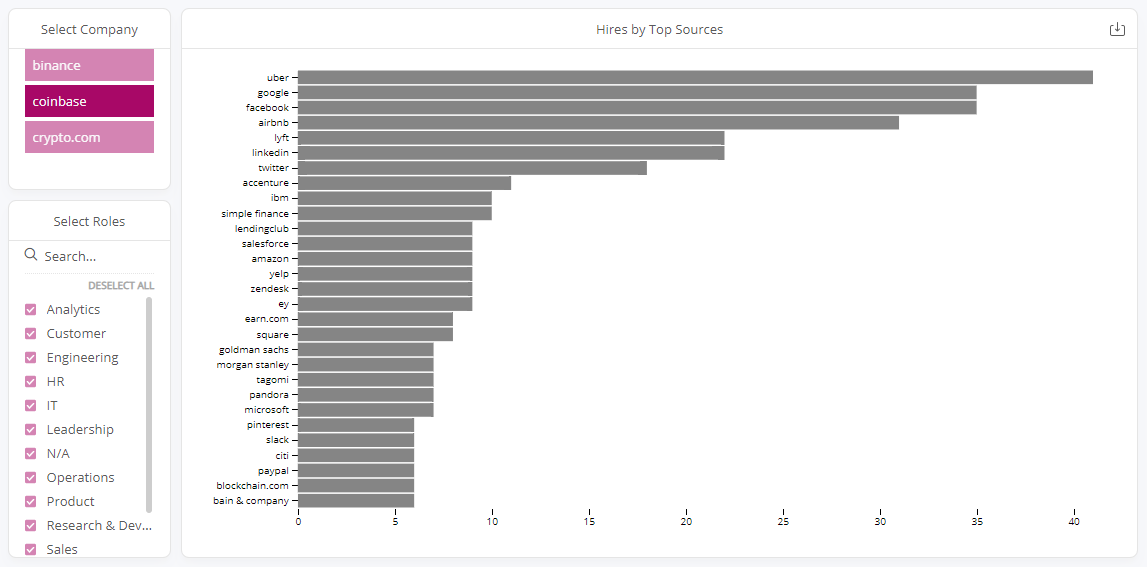

For any given company, we typically see a long tail on sources of hires. What can be quite insightful is looking at the top-most represented sources of talent. We can see some fairly premium names in tech at the top of Coinbase’s source list. It’s particularly notable to see the relative representation from Uber and Airbnb (known source of top-tier tech talent during this period) compared to Google and Facebook given difference in size of total pool for these companies.

When we look at fintech (and other “industry disruptors”), it’s always entertaining to see how much traditional domain knowledge there might actually be in the installed workforce. We’d have to go past big tech and a few neobanks before arriving at Goldman Sachs in position #19 and Morgan Stanley as well as Citi a few more spots further down. While they come from the “old world” of finance, these individuals could be critical in accelerating relationships for institutional products.

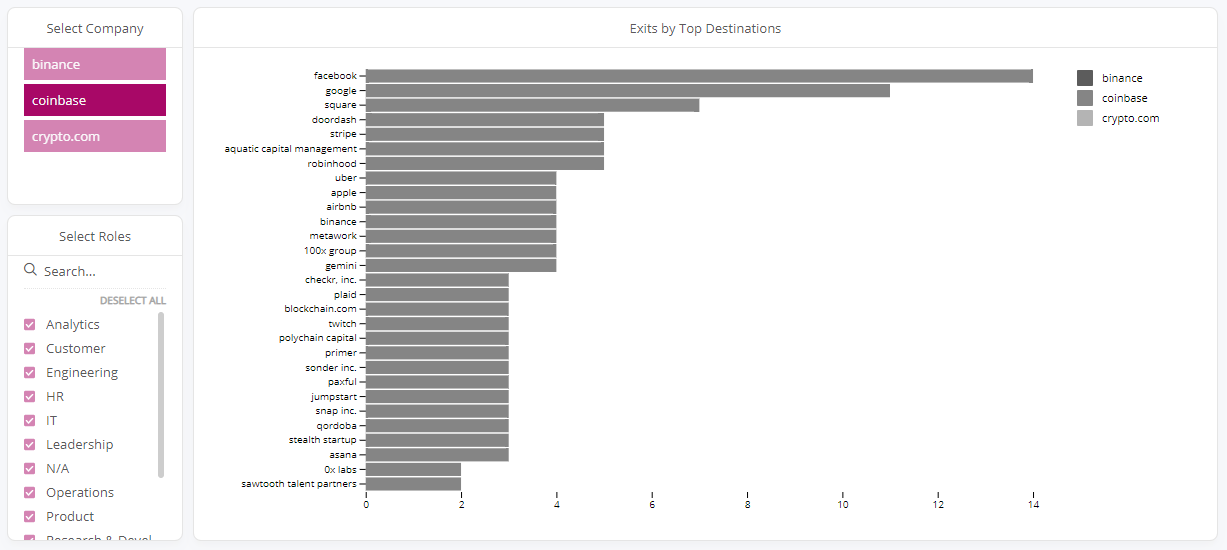

Given Coinbase’s rapid net talent growth, we’d expect departures to be significantly lower than arrivals. Top of the list (Facebook, Google) are likely there purely on size of talent demand footprint. Looking at this list, we do notice a few competitors who have taken a handful of Coinbase talent over the past few years (Square - likely for Cash App, Robinhood, Binance). However, it’s important to note that for both arrivals and departures, it’s unclear whether transitions were voluntary or involuntary. We do get some hints when we see outsized movements (e.g. Uber arrivals to Coinbase) that it was likely a targeted recruiting campaign.

One name pops out among the rest as unfamiliar — who is Aquatic Capital? An examination of the data shows that Aquatic hired a team of 5 developers from Coinbase’s Greater Chicago operations in the summer of 2019. Per LinkedIn, these 5 developers represent ~1/6th Aquatics’ team today. Given the staggered starts, Aquatic may have targeted a senior individual first, who then brought a few members of their existing team along. Looks like they saw an opportunity to ‘efficiently’ grab some talent.

Putting it into context

When looking at talent, it’s often helpful to put things into relative context — hard to put a “good” or “bad” label on things but much easier to observe differences and how they might challenge preconceived notions. With this mind, let’s compare Coinbase to a few of its competitors.

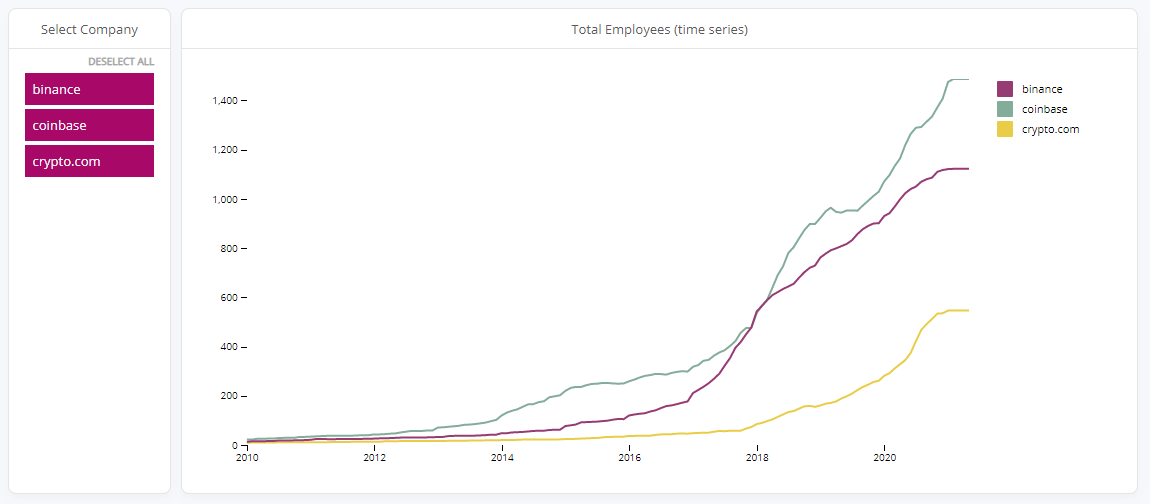

We can see that Binance was quickly accelerating talent growth through 2017, nearly eclipsing Coinbase’s talent footprint. Coinbase’s Series D toward the end of 2017 gave it another leg up on hiring. Crypto.com was later to the show but has demonstrated that there’s enough to go around with relatively fast growth.

Take-aways

Using Coinbase as a case study, we can see how outside-in talent data can be used creatively and effectively to:

Diligence historical growth trajectory and impact of catalytic events

Understand talent quality and capability using sources and destinations as relative proxies

Compare operating models against direct competitors

If you enjoyed this content, consider sharing or subscribing!